Visa Inc.

Weekly Valuation – Valutico | January 03, 2024

Inside Visa

The origin of Visa Inc. goes back to the launch of the BankAmericard, a consumer credit program by Bank of America in 1958. The program was led by Mr. Dee Hock’s vision to bring together various banks as members of a “non-stock, for profit membership corporation” and operate credit cards under the ‘Visa’ franchise. Visa Inc. became a publicly traded corporation in 2008. Today, Visa has emerged as a global payments technology company that facilitates money movement and transactions across more than 200 countries and territories through VisaNet. The Company’s core products include credit, debit and prepaid cards. These cards are issued by the affiliated financial institutions and not by Visa itself since the Company is not a financial institution.

Diving into Visa’s Business Model & Competitive Landscape

Visa operates on an open-loop payment system. An open-loop system refers to a financial transaction network where transactions can occur between various parties, including consumers, merchants, financial institutions, and other service providers. Visa generates revenue through transaction processing fees, service fees, licensing, and other charges. Issuers, typically banks, provide Visa-branded cards to consumers, who use them to make purchases at merchants that accept Visa worldwide. The Visa network plays a crucial role in authorizing, clearing, and settling transactions, ensuring the seamless transfer of funds.

As per the statistics published by Nilson Report in May 2023, the market share of Visa in the total purchase transactions on global general card networks for 2022 was 39% whereas the shares of Mastercard and UnionPay were 24% and 34% respectively.

Financial Outlook

Visa closed FY2023 (ending September 30) with a revenue of $32.7 billion (up 11% y-o-y) and GAAP net income of $17.3 billion (up 15% y-o-y). This growth has been driven by resilient consumer spending and post pandemic travel rebound as evidenced by 9% growth in global payment volumes and 20% growth in cross border volumes during the fiscal year. The Company expects FY2024 to be a normal year as the impact of Ukraine-Russia war and COVID-19 pandemic have been majorly mitigated. Moreover, the operating margins have been stable in the range of 68-70% over the past three years and are expected to remain in a similar range.

Stock Market Implications

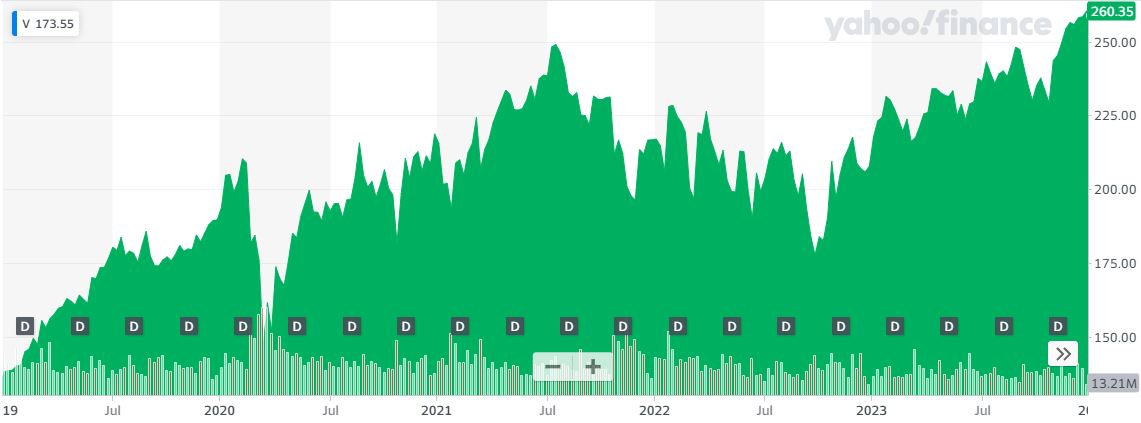

The financial performance of Visa is strongly affected by macroeconomic factors. At the start of the COVID-19 pandemic in March 2020, the Visa’s stock fell by 15% year to date due to an uncertain economic environment. As the overall market recovered and digital payments replaced cash, Visa’s stock grew by almost 50% in July 2021 from the lows of March 2020.

The Russia-Ukraine war that broke out in early 2022 led to global economies suffering from rising inflation and caused a hit to overall consumer spending. As a result, the stock fell by 15% year to date by September 2022 along with an overall market decline. With a gradual recovery in Visa’s revenue growth and increasing cross border transactions led by recovery of international travel trends, the stock price has again reached to $250 levels in December 2023. Visa is currently the 11th most valuable company globally in terms of market capitalization.

https://yhoo.it/4assXgt

Valutico Analysis

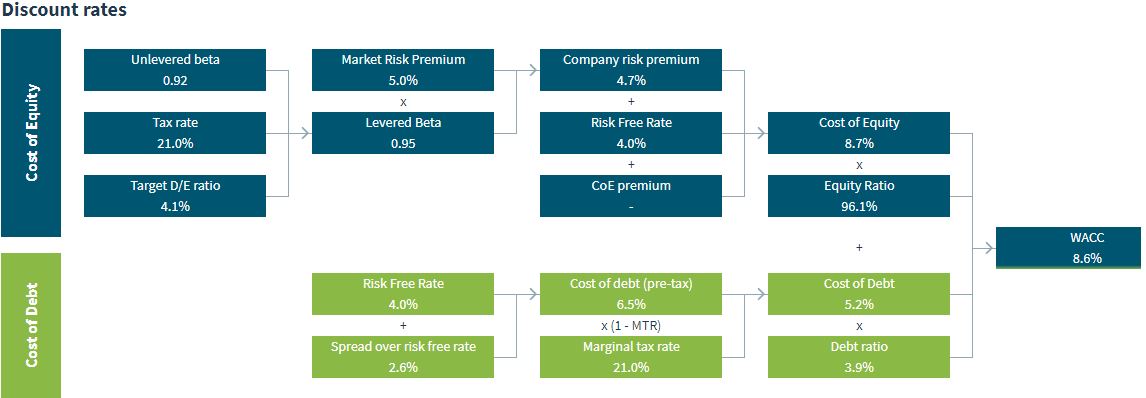

We conducted a thorough analysis of Visa employing the Discounted Cash Flow (DCF) methodology, particularly leveraging our DCF WACC approach, alongside a Trading Comparables analysis. The DCF analysis yielded a valuation of USD 367 billion, predicated on a WACC of 8.6%.

Additionally, the Trading Comparables analysis generated a valuation range of USD 220 billion to USD 290 billion, by utilizing observed metrics such as EV/EBITDA, EV/EBIT, and P/E ratios. For a robust comparative landscape, we enlisted similar market players like Mastercard Incorporated, American Express Company and Paypal Holdings, Inc. Based on our analysis, Visa is currently overvalued considering both the intrinsic value and valuation of its peers. However, higher valuation multiples of Visa versus its peers can be attributed to its higher market share and higher operating margins.

Visa is working towards strengthening its payment infrastructure as evidenced by its recent acquisitions of fintech companies such as Pismo, Currencycloud and Tink. Instant payment platforms such as UPI (India), Pix (Brazil) and FedNow (US) are set to compete with giants such as Visa and Mastercard with their growing and faster payment processing capabilities. Going forward, it shall be exciting to see if these new technologies will reduce Visa’s share in the global payments pie or in turn increase the overall pie size with increased adoption of digital payments, making Visa an even stronger player in the market?

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.