Get your free Valuation Methods Guidebook - Download

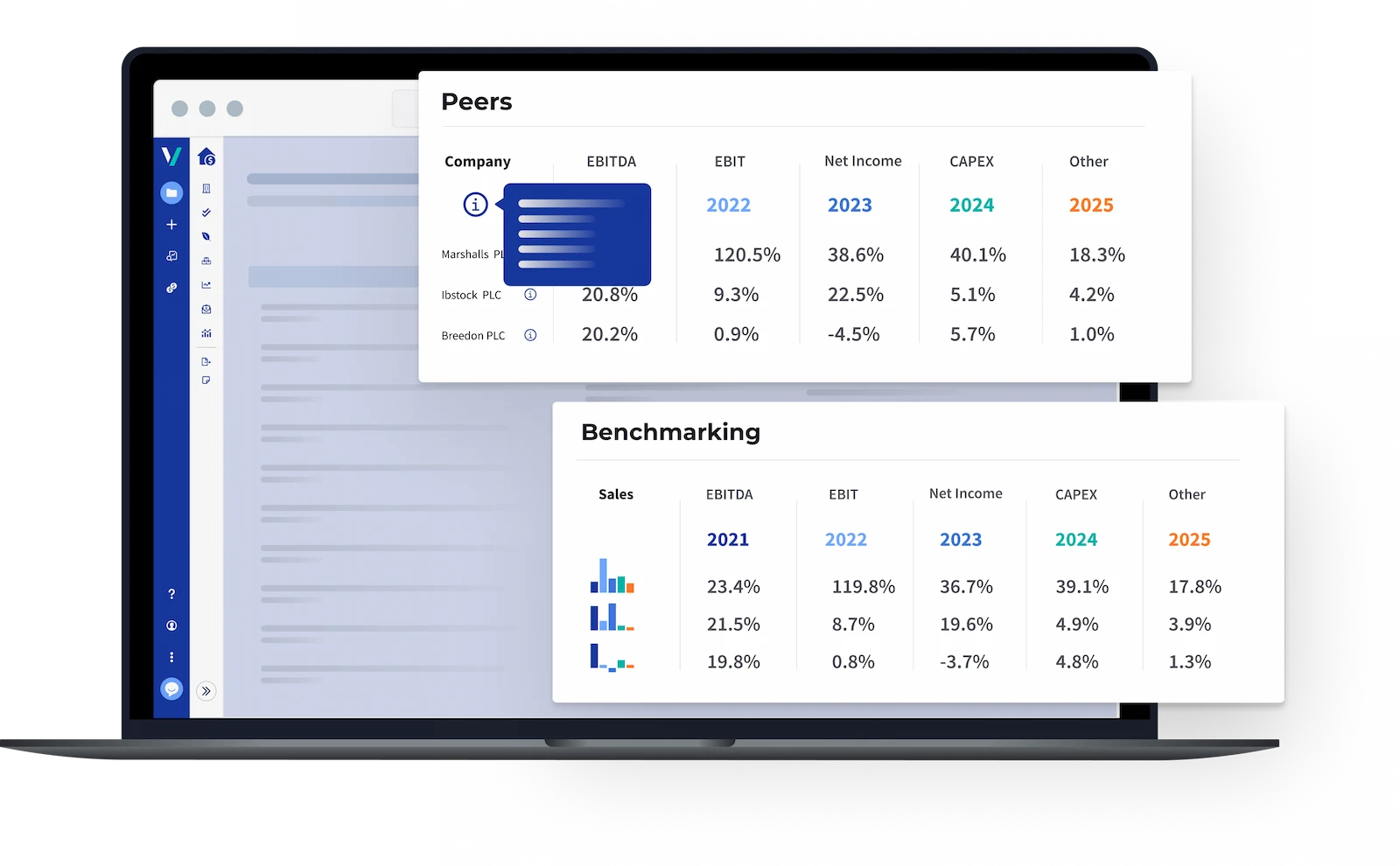

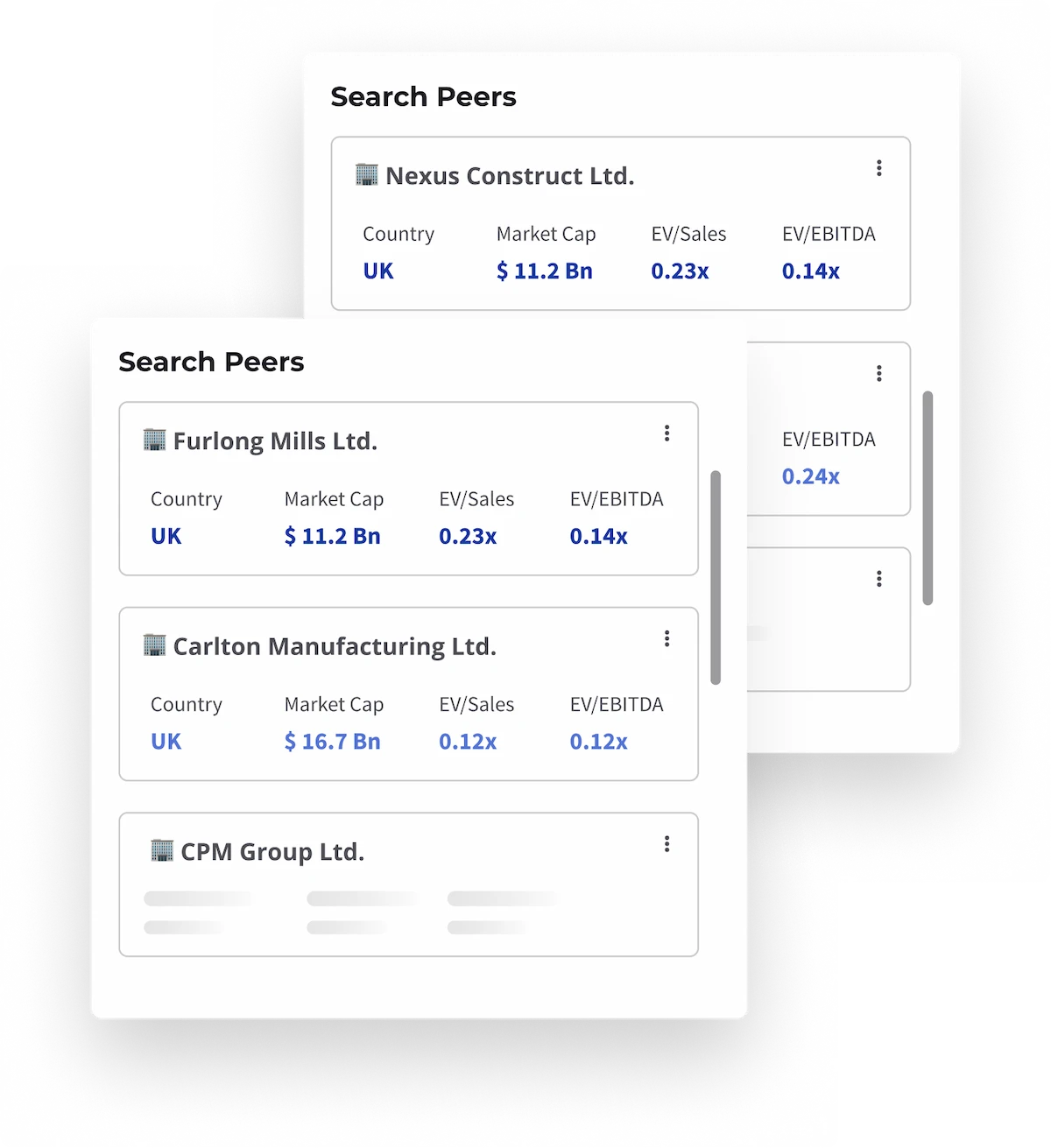

Valuing a private company involves broad market knowledge and data sourcing, which can be time-consuming. Valutico accelerates this process from start-to-finish.

The Discounted Cash Flow (DCF) method is important in valuing private companies, as it leans on future cash flow estimates. Valutico helps you ensure your forecasts make sense:

The Qualitative Assessment helps determine the discount rate, and quantify subjective risks, but the platform also provides full flexibility to adjust the underlying parameters.

The platform also features transparent beta calculations

(levered and unlevered)