Spotify Technology S.A.

Biweekly Valuation – Valutico | March 14, 2024

Subscribers & revenue hit

2023 stands as a landmark year for Spotify, marking unparalleled achievements in subscriber growth and revenue enhancement. Achieving a record-breaking 31 million premium net additions, Spotify demonstrated its efficacy in converting free users into premium subscribers, bolstering its financial outcomes. This growth was further amplified by an impressive surge in Monthly Active Users (MAUs), totaling an increase of 113 million globally. Such figures not only underscore Spotify’s widespread appeal but also its effectiveness in engaging users across diverse markets.

Path to profitability

Despite recording an operating loss in 2023, Spotify is poised for a brighter financial future. The company is gearing up to focus more sharply on monetization and efficiency in 2024. With a solid foundation of users, Spotify plans to boost its revenue through thoughtful price adjustments, the introduction of innovative products, and improved resource management.

The competitive streaming scene

Spotify holds a dominant position in the music streaming industry, with a substantial share of the global market. This dominance is challenged by competitors like Apple Music, Amazon Music, and YouTube Music. Each rival brings unique strengths, such as Apple Music’s deep integration with iOS devices and Amazon Music’s tie-in with Amazon Prime. Despite the competition, Spotify’s vast music library, user-friendly interface, and personalized playlists help it maintain a leading position.

The battle against Apple

Spotify has raised concerns over Apple Music’s competitive practices, leading to an EU lawsuit with a fine of $2 billion imposed on Apple. The core of Spotify’s complaint revolves around Apple’s control over the iOS ecosystem and the alleged preferential treatment of Apple Music. This legal action highlights the ongoing battle for fair competition in the digital music streaming space.

Valutico’s View

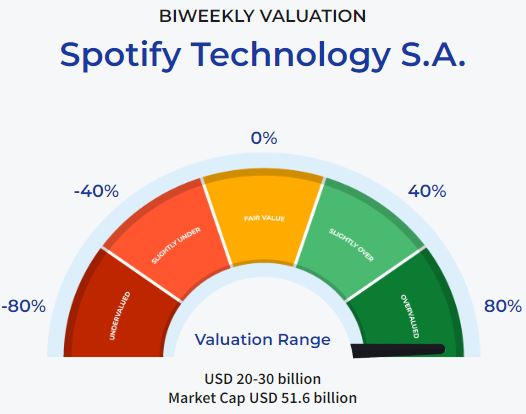

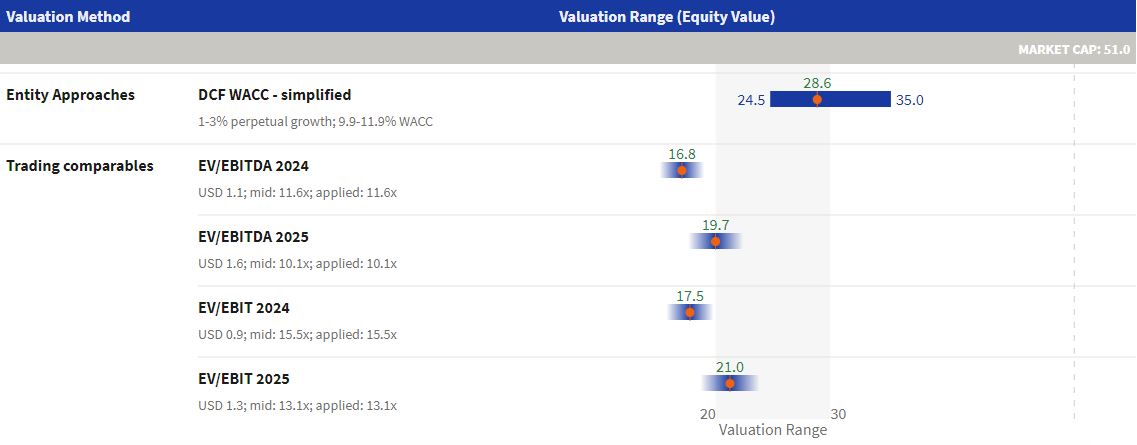

Valutico’s assessment suggests that Spotify may be overvalued. The Discounted Cash Flow (DCF) valuation estimates Spotify’s worth at USD 28.6 billion, while Trading Comparables indicate a valuation range between USD 16-21 billion. Following the announcement of unexpected profits in Q3 2023, Spotify’s stock experienced a significant rally, surging nearly 60% in five months since the release of these results. This overvaluation appears to stem from the market’s enthusiastic response to the unexpected profitability and an optimistic perspective on Spotify’s financial future.

Conclusion

Spotify’s journey in 2023 was marked by substantial subscriber and revenue growth, overshadowed by an operating loss due to strategic investments. Looking ahead, the company is focusing on monetization strategies to achieve profitability in 2024. Despite intense competition and regulatory challenges, Spotify’s strong market position and innovative offerings make it a significant player in the music streaming industry.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.