Archer-Daniels-Midland Company

Biweekly Valuation – Valutico | February 6, 2024

About the Company

Founded in 1902, Archer-Daniels-Midland Company (ADM) is a US based global food processing and commodities trading corporation focusing on human and animal nutrition products.

Accounting Probe by SEC

ADM’s CFO, Mr. Vikram Luther, has been put on administrative leave and replaced by Mr. Ismael Roig as interim CFO. This change follows an investigation into accounting practices in ADM’s Nutrition reporting segment, prompted by a voluntary document request from the U.S. Securities and Exchange Commission (SEC). ADM has also postponed the Q4 2023 earnings release. Post this announcement, ADM stock plunged more than 24% on January 22, 2024.

Underperforming Nutrition Segment

Since 2014, ADM has invested heavily in its high-margin nutrition segment to offset the commodity nature of other business segments like oilseeds and carbohydrates. However, the nutrition segment’s performance has fallen short of ADM’s growth and profitability expectations.

Shareholder lawsuit exacerbated ADM woes

A shareholder of ADM has initiated a class action lawsuit to seek damages for investors who bought ADM stock between April 30, 2020, and the date of the lawsuit, citing executive stock awards tied to the nutrition segment’s performance as incentives for misleading statements on the segment’s performance and prospects. As per certain reports, the U.S. Attorney’s Office for the Southern District of New York has conducted interviews with former ADM employees regarding the Company’s accounting practices.

Valutico’s View

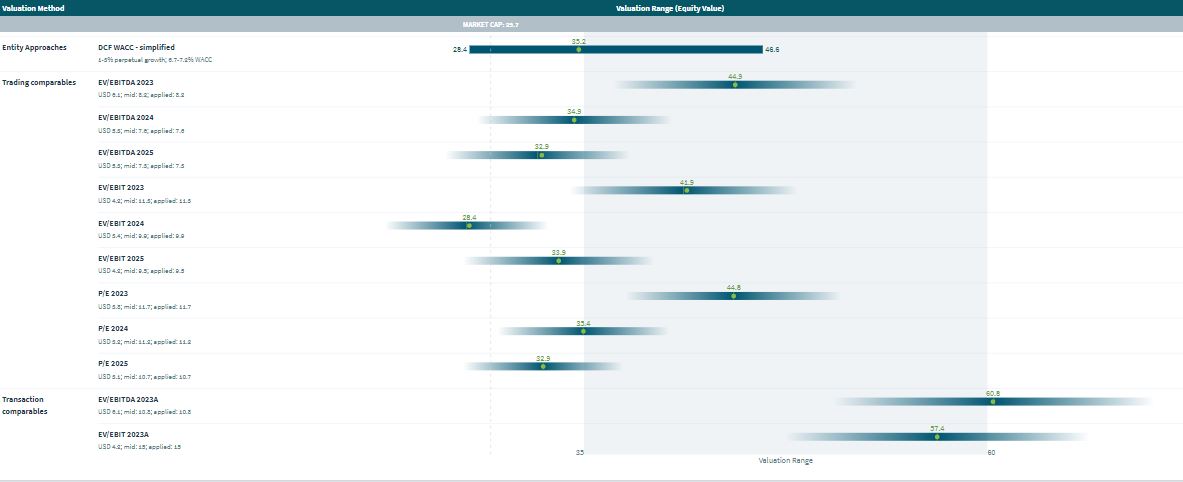

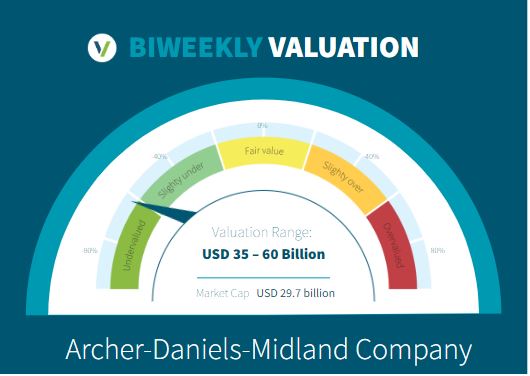

Valutico’s analysis indicates slight undervaluation of ADM. DCF valuation is at USD 35.2 billion, with Trading & Transaction Comparables suggesting USD 30-60 billion. ADM’s financial growth amid the pandemic and Russia Ukraine war-driven supply chain and inflationary issues is notable. However, the undervaluation reflects market caution amidst global economic uncertainty.

Conclusion

The ongoing investigation’s financial consequences play a crucial role in shaping ADM’s future outlook. Additionally, restoring investor confidence and addressing shareholder concerns are pivotal challenges for ADM.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.