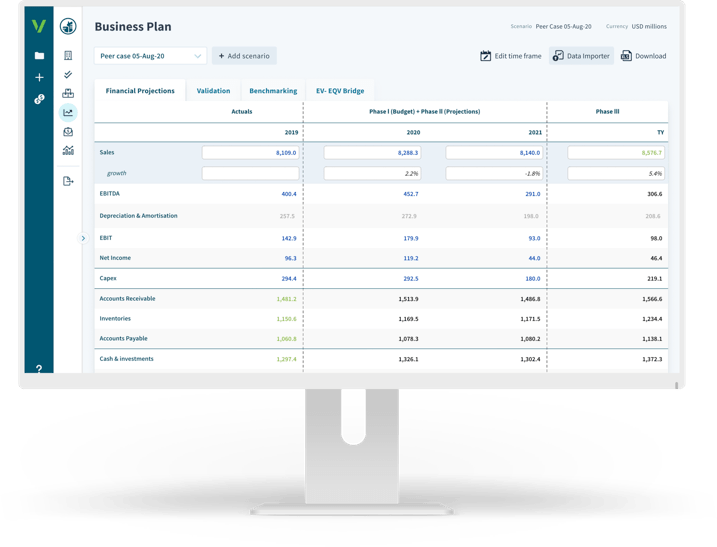

Search over 1 million precedent transactions and build quick P&L forecasts including multiple scenarios to build a dealbook for any opportunity and face your LPs, counterparties, and other stakeholders with the best data in your corner.

Track the evolution of private and publicly listed companies in your targeted sectors and take the pulse of private or public markets towards your investment thesis.

Quickly assess the fundamentals of any listed company, valuation multiples and estimates according to 28 methods to spot undervalued opportunities.

In the landscape of business valuation, financial multiples, averages, ratios and benchmarks are essential. Valutico provides multiples (over current year and forward projections) for key metrics such as revenue, EBIT, EBITDA, Net Income; as well as important ratios such as CAPEX as as a percentage of revenue, DSO, and others. Overcoming the challenges of performing a valuation starts with having the right level of information to be confident in your deal assumptions.