What is ValutECO?

A tool that allows financial professionals to incorporate Environmental, Social and Governance (ESG) aspects in the valuation of a company.

How does ValutECO work?

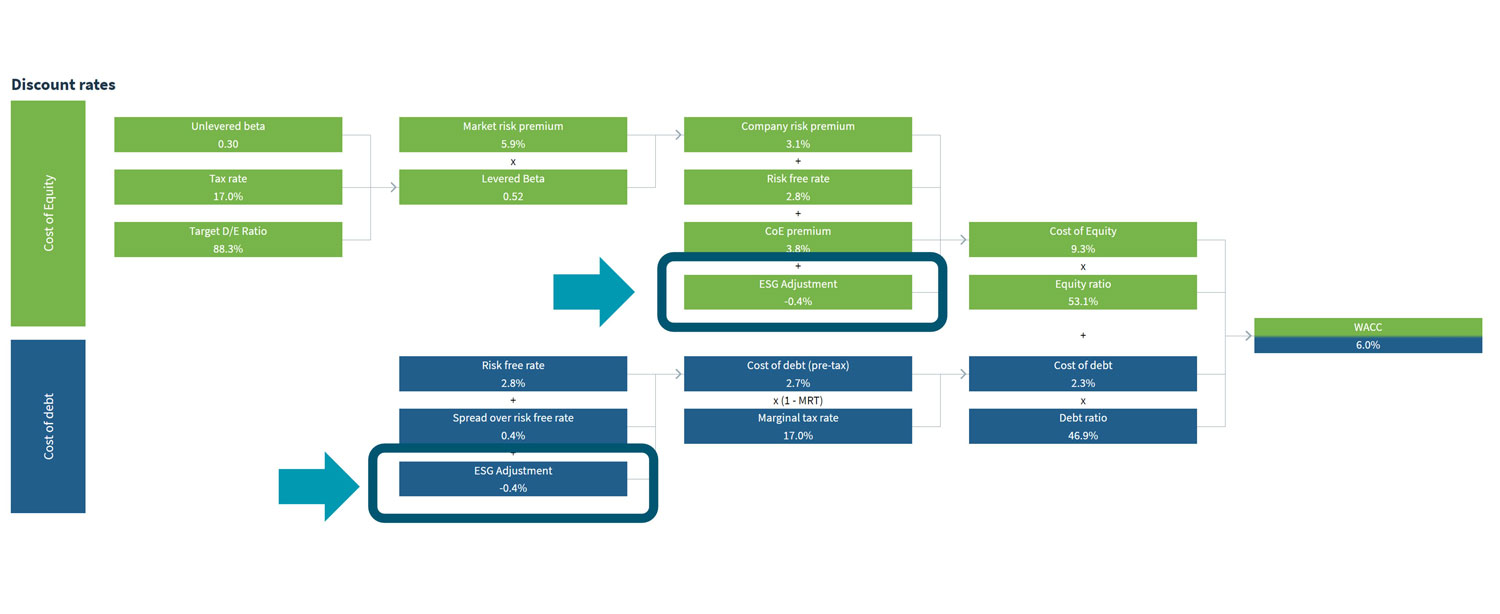

Users complete a streamlined ESG assessment of the target company to arrive at an ESG score. The ESG score feeds into our proprietary algorithm to derive an appropriate adjustment to the Cost of Equity and Cost of Debt, which impacts the final valuation.

Who is ValutECO for?

All finance professionals who value companies, such as accountants, auditors, tax advisors, M&A professionals, investment managers, corporate finance advisors, and banks who want to consider ESG factors as part of their decision-making process, especially as an input to the valuation.

How are the Cost of Capital adjustments calculated?

Valutico developed a proprietary Cost of Capital adjustment algorithm, based on the ESG scores of listed companies, obtained from S&P Capital IQ. We performed a detailed linear regression analysis, considering the betas and credit spread of listed companies, regressed against their ESG scores, for the universe of listed companies globally. The ESG score of the target company is then fed through the algorithm to arrive at Cost of Capital discount or premium, which in turn will affect the Discounted Cash Flow valuation result.

The higher the ESG score, the higher the Cost of Capital discount, which results in a lower overall Cost of Capital and thus a higher valuation. For very low ESG scores, the algorithm will apply a Cost of Capital premium, increasing the overall Cost of Capital and thus decreasing the valuation.

As a general rule of thumb, ValutECO will generally apply a ~0.08% discount to the Cost of Equity and a ~0.09% discount to the Cost of Debt for every 10 point improvement in a company’s ESG score.

Similarly to the Qualitative Assessment, it is up to the discretion of the user as to whether they wish to use these specific discounts or premiums in their final valuation. The ESG industry is relatively nascent and thus, as a new tool, this approach is not yet a widely adopted standard across the industry.

ValutECO is still in Alpha Phase – what does this mean?

Valutico appreciates that neither a universally accepted standard for ESG scoring, nor a universally accepted standard for ESG valuation analysis, currently exist. As such, we are launching ValutECO as a viable tool at an early stage of development, to solicit feedback, work closely with users to understand their needs in this area and develop ValutECO into a tool that could be more widely adopted. Notably, this means ValutECO can be considered as still under development and subject to change at any time.

Do I need a Valutico subscription to use ValutECO?

Yes, in order to access ValutECO you need a subscription to the Valutico valuation platform.

I do not have a subscription to ValutECO, how do I use ValutECO?

You will need access to Valutico to use ValutECO. Within the platform it features as an optional step. Users can also utilise the ESG assessment component by itself, without applying any ESG adjustment , in case they wish to conduct their standard valuation but still discuss ESG issues with their clients separately. If you are a Valutico user, read the next FAQ response for more information.

I am a Valutico user, how do I use ValutECO?

If you’re a Valutico user, reach out to customer service and they can provide you access. ValutECO’s launch add-on price point is established at between $200 – $500, with 100% of sales being donated to the World Land Trust Charity, patroned by David Attenborough. Valutico extends a cordial invitation to contribute beyond the stipulated amount.

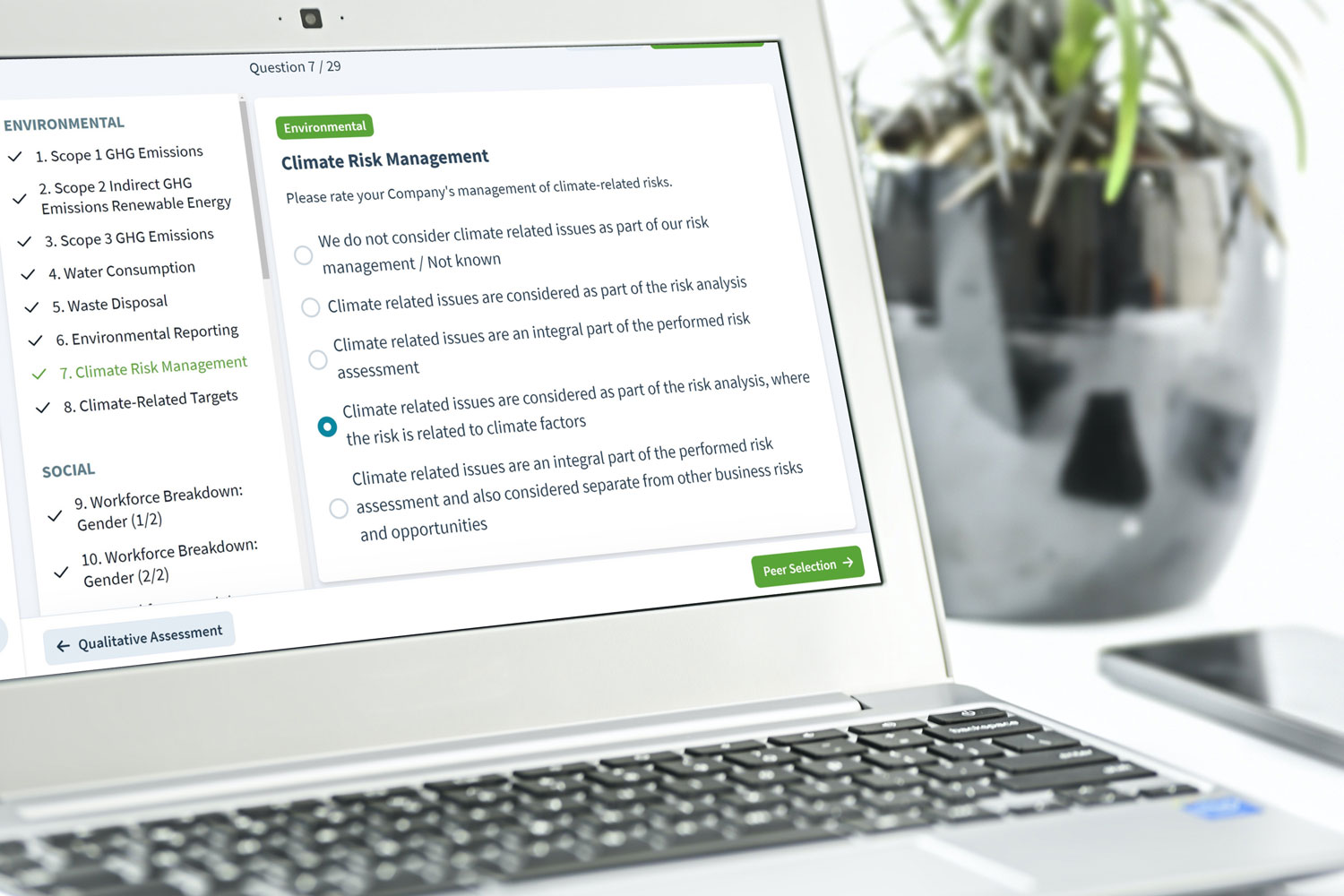

Once you have access to ValutECO, a new step will be added to the valuation workflow. Upon entering this step, you have the choice to start or skip the ESG assessment. In the former case, you will conduct a short 29-question ESG assessment, which provides an overall ESG score, as well as dimension scores for E, S and G. Your overall ESG score has an impact on the Cost of Capital, which impacts the discount rate applied to all DCF-based valuation approaches. You may also choose to conduct the ValutECO assessment for informational purposes, but not apply any Cost of Capital adjustments. In order to do so, simply deactivate the toggle on the ValutECO result screen, or in the parameters on the valuation screen.

Where do I see the impact in Valutico’s valuation platform?

If activated, the Cost of Equity and Cost of Debt adjustments will be shown in the Discount Rate table on the Valuation screen, per the screenshot below:

How can we advise clients of the impact of the ESG report?

There are at least two ways you might want to use this tool with clients:

- Demonstrate their ESG score, in order to discuss which aspects across Environmental, Social and Governance dimensions they should be aware of, in order to future-proof the value of their business

- Indicate the difference between a valuation that incorporates the ESG score into the valuation, versus one that does not. This might be a positive or negative impact, showing the effect of certain ESG aspects on the value of the business

Is the streamlined ESG survey consistent with longer-format ESG surveys?

Yes, the condensed ESG survey is broadly consistent with the S&P Capital IQ ESG scoring mechanism, but is focused on SMEs as opposed to large, listed companies.

When would you recommend using ValutECO?

We built the ValutECO methodology with private SMEs in mind, for which complex probability-weighted ESG cashflow scenarios might pose an insurmountable or expensive challenge. We want to lower the barrier to ESG adoption for these types of companies. The questionnaire is purposely kept as broadly applicable as possible.

Some notable use cases for ValutECO include:

- Sell-side M&A: showcase the positive impact of a good ESG performance and justify an elevated valuation

- Private Equity: showcase the positive impact of a good ESG performance and justify an elevated valuation; satisfy ESG requirements by your LPs

- Sustainability / Management consulting: help clients understand ESG is not just a soft factor, but translates into tangible value

When would you recommend NOT using ValutECO?

Users should not use the Cost of Capital adjustments generated by ValutECO if their forecasts already include ESG impacts, in order to avoid double-counting.