Weekly Valuation – Valutico | 2 September 2022

About McDonald’s

McDonald’s reported strong business growth in the second quarter (end of July), but earned significantly less due to high expenses and the withdrawal from its Russian operations. Profit fell by 46% to USD 1.2 billion, although the company was able to increase its sales by 9.7% in all regions ( excluding Russia).

How is McDonald’s performing?

Due to the withdrawal from business in Russia as a result of the Ukraine war, McDonald’s was forced to bear an extraordinary charge of USD 1.2 billion. Another burden is rising costs and high inflation, as a result revenue fell by three percent to USD 5.7 billion. However, looking at sales figures excluding the Russian operation, McDonald’s did an extraordinary job as they exceeded expectations with revenue growth of 9.7%.

McDonald’s was also in the media recently due to their partnership with Beyond Meat, which expired in July. This partnership had the aim of testing a plant-based alternative for the product range of the fast food restaurant. This was an important step as the competition, such as the likes of Burger King, is already offering all their burgers as plant based versions in certain markets. However, this field test with Beyond Meat patties did not have the expected success in the US. The companies therefore ended their alliance for now, which led to a sharp fall in the share price of Beyond Meat.

This year McDonald’s will pay out a dividend of USD 5.52. At the current share price of approximately USD 260, the dividend yield is 2.10% (as of September 2022). McDonald’s has increased its dividend payout every year since 1976, when the company first started paying dividends. Last year in September 2021, McDonald’s announced a 7%, or 9 cents, increase from the previous quarter (USD 1.29). The share has been listed on the stock exchange since 1965.

Valutico Analysis

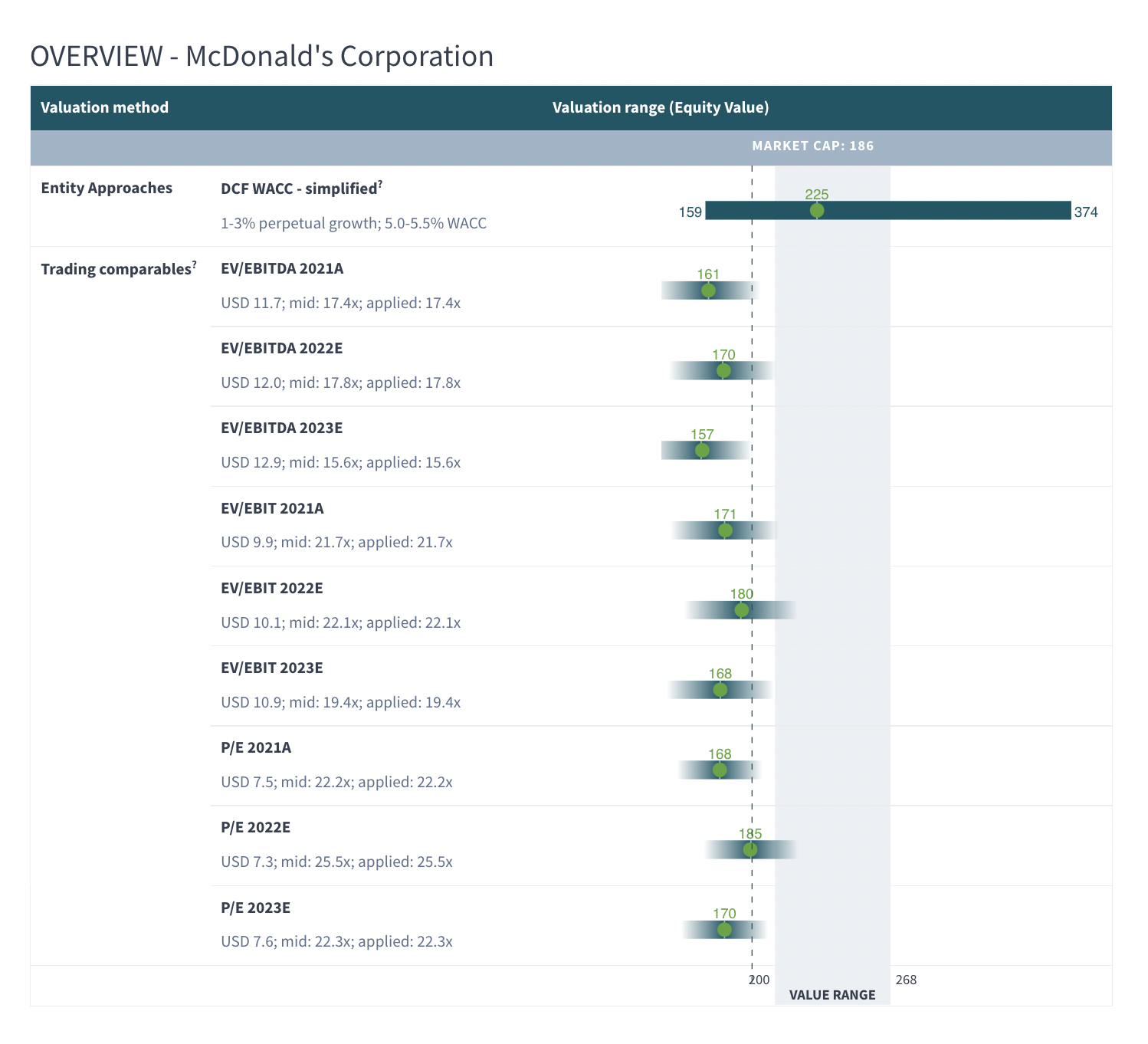

The current market cap is USD 193 billion. Our DCF WACC analysis (WACC = 5.1%) calculates a 20% higher value of USD 225 billion. Comparing McDonald’s with its peers (Domino’s, Papa John’s, Starbucks, Yum! Brands), results in a slightly lower valuation range of USD 160 to USD 180 billion.

Given the above, we conclude that McDonald’s is currently fairly valued with a valuation range of USD 160 – USD 225 billion.

Click here for the detailed valuation

Valuation Football Field

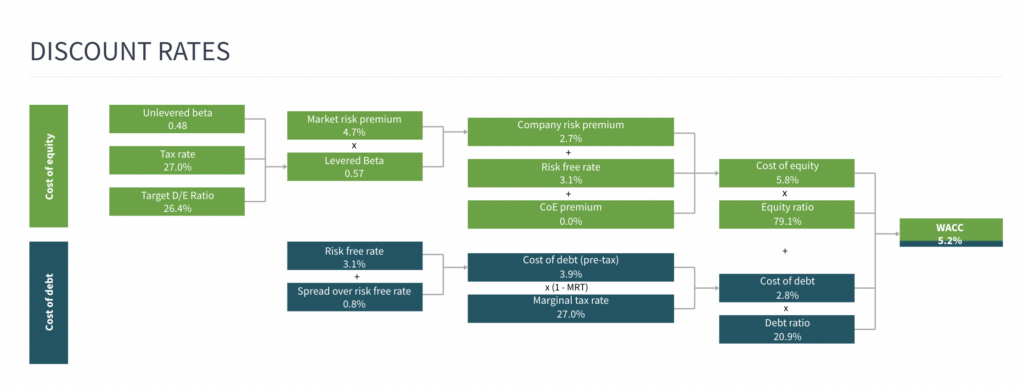

Calculating the WACC